AI agent coins have become a powerhouse in cryptocurrency markets. These coins now control a $49 billion market capitalisation and jumped an impressive 14.9% in just 24 hours. Their performance leaves traditional cryptocurrencies behind, signalling a radical alteration in investor priorities.

The dominance of top AI agent coins shows how the digital world of asset trading has evolved dramatically. Wall Street traders have changed their perspective, too—a recent J.P. Morgan survey shows 53% of them think of AI and machine learning as the most important technologies today, up from 25% last year. The blockchain AI market looks set to expand at an annual rate of 24% and could generate $10.20 billion in revenue by 2030.

AI Coins Surge 18% While Bitcoin Struggles

The cryptocurrency market saw AI tokens surge by 3.9%, with a market capitalisation of GBP 21.28 billion. This growth beat the broader crypto market’s average performance and showed strong investor confidence in AI-driven blockchain projects.

Recent market performance comparison

AI tokens combined market value grew from GBP 2.14 billion in April 2023 to GBP 20.97 billion. Individual AI tokens showed strong gains between 145% and 297% in the last 30 days. The CoinDesk Indices Computing Index, which has AI-linked tokens, rose 165% over 12 months and beat Bitcoin’s 151% increase.

AI tokens trading volumes hit a record GBP 3.02 billion in late February. Investment manager VanEck sees revenue from AI crypto projects reaching GBP 8.10 billion by 2030 in their base case, with possible growth beyond GBP 40.50 billion in their bullish outlook.

Key driving factors behind the surge

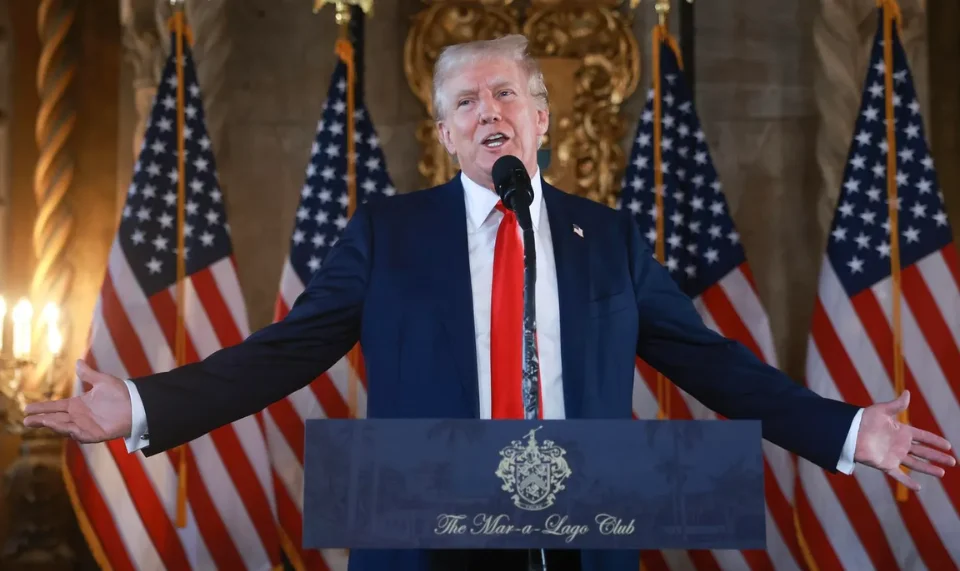

Multiple factors led to these strong results. The upcoming White House Crypto Summit created a buzz as industry leaders and policymakers met to discuss regulatory frameworks and innovation plans. It was also revealed that President Trump had announced the addition of cryptocurrencies such as XRP, Solana (SOL), and Cardano (ADA) to the U.S. strategic reserve, a move that triggered significant market reactions. With Trump’s return, financial markets are uncertain about how his policies will affect the economy and the value of money. This event sparked talk about more institutional interest in AI-focused blockchain projects.

ChatGPT 3’s launch improved market efficiency in AI-associated sectors, which led to positive returns and better liquidity. Funding for AI-related Web3 projects reached GBP 236.66 million last year. This amount beat the total financing of GBP 117.93 million from 2016 to 2022.

AI and cryptocurrency joined forces to create innovative solutions for market analysis and trading:

- Advanced market analysis through machine learning algorithms

- Real-time monitoring systems for swift decision-making

- Better risk assessment and portfolio management capabilities

- Automated trading strategies to improve efficiency

Strategic collaborations boosted the market further. The Superintelligence Alliance between Fetch.ai, SingularityNET, and Ocean Protocol wants to merge their tokens (FET, AGIX, and OCEAN) into one ASI token. This move supports an open-source, democratised approach to AI development.

How Do AI Agents Transform Crypto Trading?

AI agents have transformed cryptocurrency trading with sophisticated algorithms and machine learning capabilities. These self-operating systems analyse markets and execute trades without human intervention.

Autonomous portfolio management

Advanced algorithms help AI agents optimise asset allocation by monitoring market data and historical trends. The systems adapt portfolio balance to market conditions. These agents can proactively spot early warning signs of market downturns and adjust portfolios.

To cite an instance, Zerebro, an autonomous agent, has set up an Ethereum staking node that generates income independently. As with AIXBT, which has 450,000 followers, it offers complete crypto market insights.

Real-time market analysis capabilities

AI agents quickly turn big data sets into useful insights. These systems predict market movements by analysing social media sentiment, news articles, and blockchain data through natural language processing.

The technology excels in:

- Evaluating up-to-the-minute market conditions and trading volumes

- Identifying patterns and correlations between different cryptocurrencies

- Detecting market anomalies and potential risks

- Delivering quick insights that lead to swift decisions

Smart contract execution efficiency

AI agents boost smart contract functionality with intelligent decision-making capabilities. They work with smart contracts with predefined conditions and continuously monitor market conditions and risk factors. The contracts execute transactions when specific conditions are met, whether for trades, loan adjustments, or portfolio rebalancing.

AI and smart contract integration allow autonomous management of complex financial strategies. AI agents on DeFi lending platforms assess market changes, adjust interest rates, and predict borrower behaviour to modify loan terms. This system runs without stopping to maximise profit and minimise risk without human oversight.

Top Platforms Revolutionise Digital Asset Management

Digital asset management platforms are making groundbreaking advances in the market. Experts project this sector to reach GBP 9.53 billion by 2030.

Virtual Protocol guides gaming revolution.

Virtuals Protocol launched in October 2024 on Ethereum’s Layer 2 network Base. Users can create and monetise AI agents without coding knowledge. The platform achieved its first milestone when AI agents Luna and STIX completed a landmark transaction. Luna paid 0.262 VIRTUAL for image generation services.

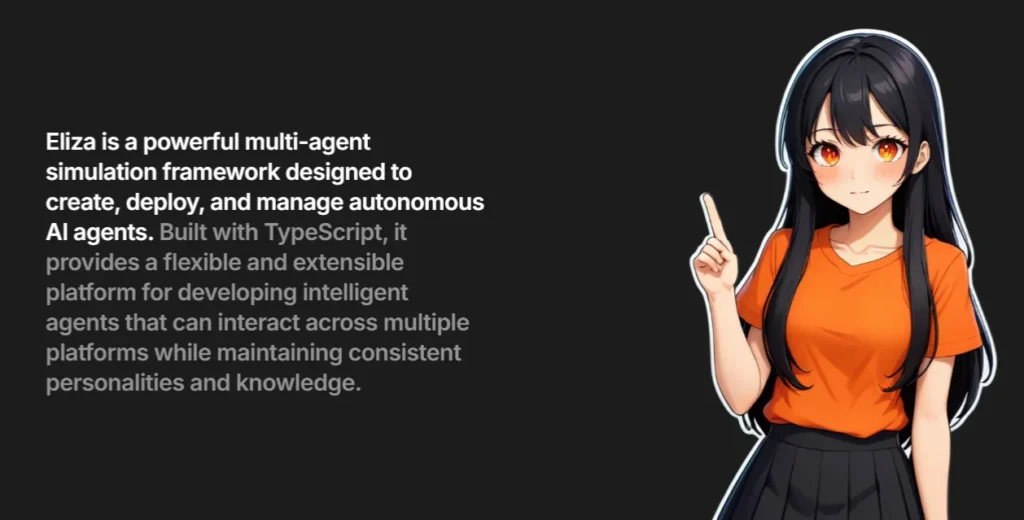

AI16z pioneers evidence-based investing

AI16z is a state-of-the-art decentralised autonomous organisation integrating artificial intelligence into treasury management and venture capital. The platform’s ElizaOS framework has become the most accessible system for AI Agents in the crypto ecosystem. More than 350 contributors are now actively developing the Eliza framework.

Freysa introduces novel security measures.

Freysa’s experimental security system showcases advanced protection mechanisms for digital assets. The platform focuses on three vital security aspects: data privacy, system security, and operating system security. These measures help fight digital fraud. Freysa improves blockchain architecture security through its state-of-the-art ‘proof of coinage’ procedure.

Artificial Superintelligence Alliance (FET)

The Artificial Superintelligence Alliance represents a strategic collaboration between Fetch.ai, SingularityNet, and Ocean Protocol. Fetch.ai’s technology stack has four key elements:

- Digital Twin Framework builds marketplaces

- Open Economic Framework provides search functions

- Digital Twin Metropolis keeps immutable records

- Fetch.ai Blockchain ensures secure consensus

The platform’s recent Capricorn mainnet upgrade makes Inter-Blockchain Communication possible. FET tokens now work across IBC-enabled chains. These developments place the alliance at the vanguard of decentralised AI innovation, especially in advancing autonomous agent capabilities.

Wall Street Giants Shift Focus to AI Coins

Recent surveys show a dramatic move in Wall Street toward AI-powered cryptocurrencies. Institutional investors now see how artificial intelligence can change digital asset trading, marking the most important development in market sentiment.

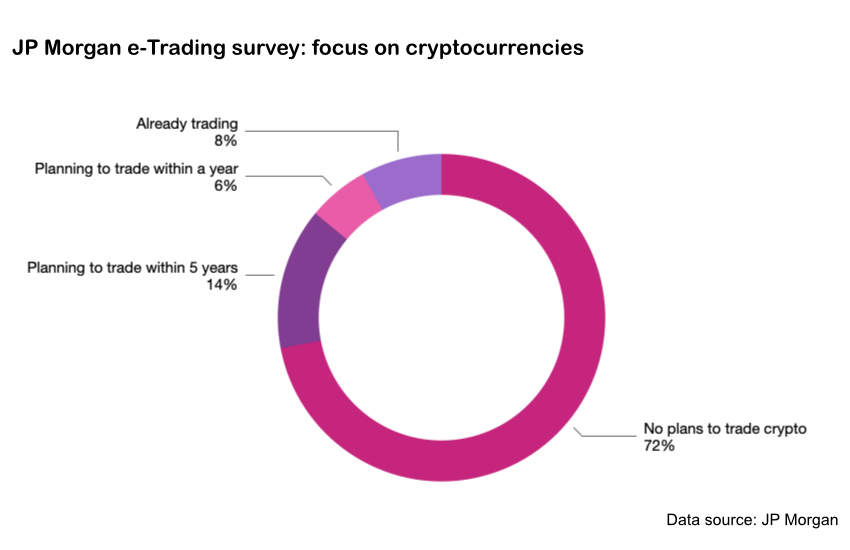

J.P. Morgan’s surprising survey results

J.P. Morgan’s latest e-Trading Edit report shows a remarkable change in technology priorities. The report gathered responses from 835 institutional traders in 60 global markets. The survey suggests that 53% of traders think about AI and machine learning as the technologies that will shape trading methods over the next three years. This number jumped from 25% last year.

The survey also reveals that 78% of institutional traders don’t plan to trade cryptocurrencies in the next five years. This number will drop to 71% by 2025. These figures suggest a slow but steady move in institutional sentiment.

Institutional adoption patterns

Institutional investors have changed their approach to cryptocurrency exposure. While 37% of institutions currently invest in spot crypto, only 32% plan to do so in the next 2-3 years. Instead, 51% want to invest in mutual funds and ETPs focusing on crypto-related companies.

62% of institutional investors would get exposure to crypto through registered vehicles rather than buy spot crypto directly. This choice points to a growing trend toward regulated investment products in the digital asset space.

Institutional investors have put substantial resources into technology and AI development:

- They spend between 1.3 and 2.7 basis points on technology and AI

- Absolute spending has risen 20% since 2020

- The top 25% of investors put in more than 3.5 basis points

The move toward AI integration matches broader market trends. Leading institutions modernise their IT infrastructure and use AI tools to improve their data processes. Yet less than 20% of participants are ready to use AI and future technologies. This suggests there’s plenty of room for institutional adoption to grow.

Conclusion – AI Agent Coins

AI agent coins lead the cryptocurrency markets today. These coins showed an impressive 14.9% increase with a $49 billion market capitalisation. Their performance has surpassed traditional cryptocurrencies such as Bitcoin, Solana and Ethereum because of strong institutional interest and better technology.

The sector’s strength shows through these leading projects:

- Virtuals Protocol (VIRTUAL) – USD 4.37, market cap USD 4.37B

- Artificial Superintelligence Alliance (FET) – USD 1.48, market cap USD 3.86B

- ai16z (AI16Z) – USD 2.07, market cap USD 2.27B

- Freysa (FAI) – USD 0.07, market cap USD 581M

- aixbt by Virtuals (AIXBT) – USD 0.52, market cap USD 520M

Wall Street’s welcome of AI technology marks a transformation in trading. About 53% of traders now see AI as the key force that shapes trading methods. While institutions adopt cryptocurrency cautiously, the sector grows at 24% yearly. Experts predict the blockchain AI sector will reach USD 10.20 billion by 2030. This growth comes from better autonomous trading and boosted portfolio management systems. AI and cryptocurrency markets meet to create new investor opportunities in this ever-changing sector. AI agent coins look ready to maintain their market leadership as regulations improve and more institutions join.

What are AI agent coins, and why are they gaining popularity?

AI agent coins are cryptocurrencies that leverage artificial intelligence for trading and portfolio management. They’re gaining popularity due to their superior market performance, advanced trading capabilities, and growing institutional interest.

How do AI agents transform crypto trading?

AI agents transform crypto trading through autonomous portfolio management, real-time market analysis, and efficient smart contract execution. They can analyse vast amounts of data, make instant decisions, and execute trades without human intervention.

Which platforms are leading the AI agent coins revolution?

Key platforms include Virtuals Protocol, AI16z, Freysa, and the Artificial Superintelligence Alliance (FET). These platforms offer unique features such as AI agent creation, evidence-based investing, and enhanced security measures.

What is Wall Street’s stance on AI in cryptocurrency trading?

Wall Street is increasingly recognising the potential of AI in cryptocurrency trading. A recent J.P. Morgan survey showed that 53% of traders now consider AI and machine learning the most influential technologies for shaping trading methods.

What is the projected growth for the AI agent coins market?

Experts project the blockchain AI market to expand at an annual rate of 24%, potentially reaching $10.20 billion in revenue by 2030. Technological advancements and increasing institutional adoption drive this growth