The first government to sign Bitcoin as legal tender was El Salvador, which exempts overseas investors from paying cryptocurrency taxes. This creative step highlights how digital currency is transforming in tax-free cryptocurrency states.

Several nations have established themselves as crypto-friendly jurisdictions. Countries with no capital gains tax, such as Singapore and the United Arab Emirates, have created attractive environments for cryptocurrency investors. Furthermore, some regions like Belarus have extended tax exemptions until 2025, while others like Germany offer tax benefits for long-term holders who keep their assets for over a year.

Understanding these tax-friendly destinations has become crucial for cryptocurrency investors seeking to maximise their returns. This guide explores the top crypto tax-free countries, their regulations, and what makes them attractive for digital asset investments.

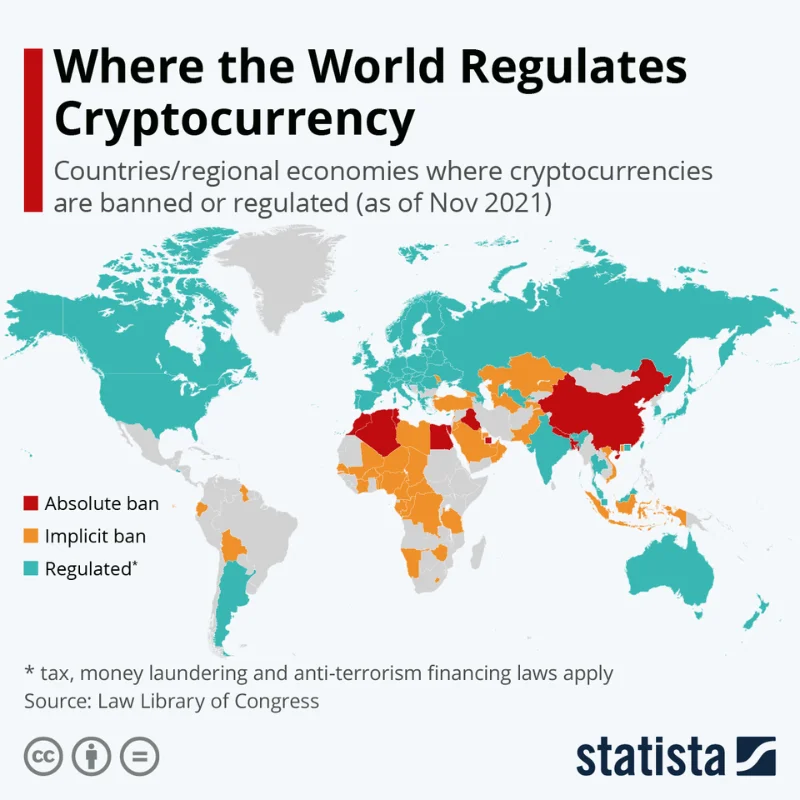

Crypto Regulations Worldwide

Cryptocurrency regulations vary significantly globally, creating a complex landscape for investors and traders. As digital assets gain prominence, governments worldwide grapple with how to classify, tax, and regulate these novel financial instruments. This section explores countries’ diverse approaches towards cryptocurrency regulation, highlighting crypto-friendly jurisdictions and those with stricter controls.

The regulatory spectrum for cryptocurrencies spans from complete bans to full legal tender status. At one end, countries like China have implemented stringent measures, effectively prohibiting cryptocurrency trading and mining. In contrast, nations like El Salvador have embraced Bitcoin as a legal tender, showcasing the wide range of regulatory stances.

Many countries fall between these extremes, adopting various regulatory frameworks. In Europe, regulatory approaches differ among member states despite efforts by the European Union to establish a unified framework. Germany, for example, recognises cryptocurrencies as private money and exempts long-term holders (over one year) from capital gains tax. This policy has made Germany an attractive destination for crypto investors seeking tax advantages.

The United Kingdom has taken a more cautious approach, classifying cryptocurrencies as property and subjecting them to capital gains tax. Asia presents a diverse regulatory landscape. While China has banned cryptocurrency trading, neighbouring Japan has embraced digital assets, recognising Bitcoin as legal property and implementing a licencing system for cryptocurrency exchanges. South Korea, another primary crypto market, requires exchanges to partner with local banks and imposes strict know-your-customer (KYC) regulations.

Several countries have positioned themselves as crypto-friendly jurisdictions, attracting investments and fostering innovation in the blockchain sector. Singapore has established itself as a hub for cryptocurrency businesses, offering a clear regulatory framework and tax incentives. Under its Payment Services Act, the Monetary Authority of Singapore (MAS) oversees cryptocurrency exchanges, encouraging innovation while guaranteeing adherence to AML and CTF regulations.

Switzerland, particularly the “Crypto Valley” in Zug, has become a prominent blockchain and cryptocurrency hub. To promote innovation in the industry and provide regulatory clarity, the Swiss Financial Market Supervisory Authority (FINMA) has set strict guidelines for initial coin offerings (ICOs), dividing cryptocurrencies into three sections: payment tokens, utility tokens, and asset tokens.

The United Arab Emirates, especially Dubai, has become a crypto-friendly destination. The Dubai Multi Commodities Centre (DMCC) has established a regulatory framework for cryptocurrency businesses, offering tax incentives and a supportive ecosystem for blockchain startups. This approach has attracted numerous cryptocurrency exchanges and blockchain companies to the region.

Some countries have taken unique approaches to cryptocurrency regulation. Belarus, for example, has implemented a special legal regime for cryptocurrency activities, offering tax exemptions until 2023 to attract blockchain businesses and investors. This policy has positioned Belarus as an emerging crypto hub in Eastern Europe.

Portugal has gained attention for its crypto-friendly tax policies. Cryptocurrency trading is exempt from value-added tax (VAT) and capital gains tax since they do not view cryptocurrencies as financial assets or securities. This approach has made Portugal an attractive destination for cryptocurrency investors seeking tax advantages.

Malta, often called “Blockchain Island,” has implemented comprehensive regulations for cryptocurrencies and blockchain technology. The Malta Digital Innovation Authority Act, the Innovative Technology Arrangement and Services Act, and the Virtual Financial Assets Act provide a robust framework for crypto businesses. These regulations aim to foster innovation while ensuring consumer protection and market integrity.

It’s important to note that cryptocurrency regulations are constantly evolving. Many countries are developing or refining their regulatory frameworks to address the challenges and opportunities provided by digital assets. As the cryptocurrency bull market matures, regulatory approaches will likely converge towards a more standardised global framework. However, significant differences in regulatory philosophies and economic priorities among nations will likely persist, maintaining a diverse landscape for cryptocurrency regulations worldwide.

Navigating this complex regulatory environment requires careful consideration and due diligence for cryptocurrency investors and businesses. While some jurisdictions offer attractive tax incentives and supportive ecosystems, ensuring compliance with local laws and regulations is crucial.

The global regulatory landscape for cryptocurrencies reflects the ongoing tension between fostering innovation and protecting consumers and financial stability. As digital assets become increasingly mainstream, finding the right balance between these objectives will be crucial for governments and regulators worldwide. The various approaches adopted by different countries provide a view into the challenges and opportunities of regulating cryptocurrencies.

Calculating Crypto Tax

Calculating cryptocurrency taxes can be complex, particularly for investors with numerous transactions across multiple platforms. As the crypto market evolves, tax authorities worldwide are developing more sophisticated approaches to ensure compliance. This section will delve into the intricacies of calculating crypto taxes, providing insights into the methods and considerations investors should consider.

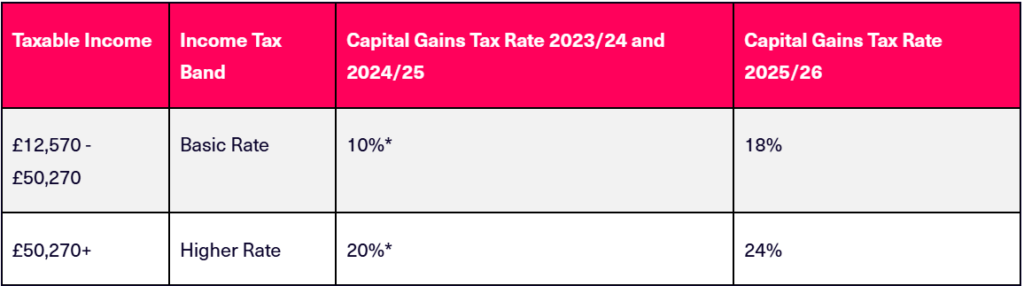

To begin with, in most jurisdictions, cryptocurrencies are treated as property for tax purposes. This classification means capital gains tax rules typically apply when disposing of crypto assets. For instance, the UK’s HM Revenue & Customs (HMRC) follows this approach, subjecting crypto gains to Capital Gains Tax (CGT).

The first step in calculating crypto taxes is determining your cost basis. The cost basis is how much you paid to acquire the cryptocurrency, including transaction fees. For those who obtained crypto through mining or staking rewards, the cost basis is generally the cryptocurrency’s fair market value on the day it was received.

Once you’ve established your cost basis, you can calculate your capital gain or loss. This is done by subtracting your cost basis from the price at which you sold the asset. If you spent, swapped, or gifted your crypto, you’d subtract your cost basis from the asset’s fair market value on the day you disposed of it.

Countries have varying approaches to calculating crypto taxes. In the UK, HMRC specifies ‘share pooling’ as the crypto cost basis method. This method prevents manipulation of gains and losses through rapid buy-sell actions that could distort the financial picture.

The UK employs three specific rules for calculating the cost basis:

- Same-Day Rule: If you purchase and sell coins on the same day, your gains or losses must be calculated using the cost basis for that day.

- Bed and Breakfasting Rule: If you sell and then repurchase the same coins or tokens within 30 days, you’ll use the cost basis of coins or tokens you bought this month to calculate your gains or losses.

- Section 104 Rule: If the above two rules are irrelevant, use this cost-basis method. It works similarly to the Average Cost Basis (ACB) approach, which divides the total amount paid for all assets by the total number of coins or tokens to determine the average cost basis for a pool of assets.

Calculating multiple transactions across various platforms can become exceedingly complex for those dealing with multiple transactions. Many investors turn to specialised crypto tax software to streamline this process. These platforms can import transaction data from various sources, apply the appropriate tax rules, and generate comprehensive reports.

However, while these tools can be a great help, the responsibility for accurate tax reporting ultimately lies with the taxpayer. HMRC’s guidance in this area continually evolves, and there is no guarantee that automatically generated reports will align perfectly with the latest HMRC position.

The calculation process differs slightly regarding income from crypto activities such as mining or staking. In such circumstances, you’ll have to figure out the coins’ or tokens’ fair market worth in pounds sterling on the day you receive them.This task can be particularly time-consuming for those with regular small incomes from such activities.

For UK residents, the annual tax-free allowance for capital gains needs to be considered. As of the 2024-2025 financial year, this allowance stands at £3,000. Gains over this amount are liable to 10% or 20% CGT, depending on your income tax category.

It’s also worth noting that losses can be used to offset gains. If your total losses in a tax year exceed your capital gains, they can be rolled forward to use against capital gains in future tax years. However, these losses must be claimed within four years of the end of the tax year in which they were realised.

For those dealing with non-fungible tokens (NFTs), it’s essential to understand that these are treated as separate, identifiable assets and are not subject to the share pooling rules that apply to fungible cryptocurrencies.

Lastly, it’s crucial to maintain detailed records of all your crypto transactions. HMRC expects records, calculations, and reporting to be undertaken in GBP. You’ll need to perform currency conversions for transactions involving other currencies or crypto-to-crypto exchanges. In cases where values are recorded in different crypto assets (usually Bitcoin), a double conversion may be necessary (Bitcoin value to USD, USD to GBP), adding another layer of complexity to the calculations.

Given the intricacies of calculating crypto taxes, many investors find it beneficial to seek professional advice. A tax professional with experience in cryptocurrency can help navigate the complexities of the tax code, ensure compliance with the latest regulations, and potentially identify strategies to optimise your tax position.

Tax authorities will likely continue refining their approach to cryptocurrency taxation as we move forward. The UK government has already announced plans to introduce a dedicated section for crypto assets on the capital gains pages of the UK self-assessment tax return from 2024-25 onwards. This change underscores the growing importance of accurate crypto tax reporting and may signal increased scrutiny of crypto transactions in the future.

10 No Crypto Tax Countries

As the cryptocurrency market expands, investors are increasingly seeking jurisdictions that offer favourable tax treatment for digital assets. These tax-free crypto countries have emerged as attractive destinations for those looking to maximise their returns and minimise their tax liabilities. Let’s explore some of the most prominent crypto tax havens worldwide.

1. El Salvador

It was a big deal when El Salvador became the first country to accept Bitcoin as legal cash. This groundbreaking move accompanied significant tax incentives for crypto investors. Foreign investors became exempt from paying capital gains tax on Bitcoin profits. This policy aims to attract international investment and stimulate economic growth in the Central American nation.

2. Portugal

Portugal has long been a favourite among crypto enthusiasts due to its favourable tax policies. Until recently, the country imposed no taxes on cryptocurrency transactions. However, in 2023, Portugal revised its stance, introducing a capital gains tax of close to 30% on profits from crypto held for less than a year. Nevertheless, long-term holdings exceeding one year remain tax-free, maintaining Portugal’s appeal for crypto investors.

3. Germany

Germany takes a unique approach to crypto taxation, incentivising long-term investment. While short-term gains (held for less than one year) are subject to a substantial 45% tax, profits from crypto assets held for more than a year are entirely tax-exempt. This policy encourages investors to adopt a ‘hodl’ strategy, potentially stabilising the market and reducing volatility.

4. Switzerland

Often referred to as ‘Crypto Valley’, Switzerland has established itself as a leading blockchain and cryptocurrency innovation hub.” Investors and blockchain companies are especially drawn to the nation’s tax structure. Profits from bitcoin trades are excluded from capital gains tax, which is advantageous to private individuals. This policy and Switzerland’s robust financial infrastructure have attracted crypto startups as well as investors to the Alpine nation.

5. Singapore

Singapore has emerged as a crypto-friendly jurisdiction, offering a favourable tax environment for individual investors. The city-state does not impose a capital gains tax, allowing investors to retain more crypto profits. This policy, coupled with Singapore’s reputation as a financial hub, has made it a destination for crypto entrepreneurs and investors.

6. Malta

Known as the ‘Blockchain Island,’ Malta has positioned itself as a crypto-friendly nation with attractive tax policies. It offers a 0% tax rate on long-term capital gains from cryptocurrencies held as investments. This approach has drawn numerous blockchain and crypto companies to establish operations in Malta, contributing to its growing reputation as a crypto hub.

7. Cayman Islands

The Cayman Islands have long been recognised as a tax haven, and this reputation extends to the cryptocurrency sector. The islands offer a tax-neutral environment without income, capital gains, or value-added cryptocurrency taxes. This policy has made the Cayman Islands popular for crypto hedge funds and other digital asset investment vehicles.

8. Belarus

Belarus has taken a proactive approach to attract cryptocurrency investors and businesses. The country has implemented tax incentives that exempt crypto-related activities from taxation until January 1, 2025. This policy covers many activities, including mining, buying, and selling cryptocurrencies, making Belarus an emerging hotspot for crypto entrepreneurs.

9. Panama

Panama’s territorial tax system exempts foreign-sourced income from taxation, including cryptocurrency gains. This policy, combined with the country’s established reputation as a financial centre, has made Panama an attractive option for crypto investors seeking to minimise their tax liabilities.

10. Hong Kong

Hong Kong offers a favourable tax environment for crypto investors and businesses. The city currently exempts long-term individual investments from capital gains tax. This policy and Hong Kong’s status as a global financial hub have attracted numerous cryptocurrency exchanges and blockchain companies to establish regional operations.

It’s worth noting that while these jurisdictions offer attractive tax policies for crypto investors, the reasons behind their approaches vary. Some countries, like El Salvador and Switzerland, have declared themselves crypto tax-free havens to attract industry leaders and stimulate economic growth. Others, like the United Arab Emirates, rely on different sources of income, like oil exports and tourism, rather than personal income taxes.

Implementing crypto-friendly tax policies can be seen as a strategic move by these countries to position themselves as innovation hotspots and attract investment in the burgeoning blockchain and cryptocurrency sectors. By removing or reducing tax burdens, these nations aim to create an environment that supports the growth of crypto and blockchain companies.

However, investors must consider the broader implications of relocating to these tax havens. Factors such as regulatory clarity, banking infrastructure, and the presence of a thriving crypto community can significantly impact a jurisdiction’s overall attractiveness for crypto activities.

While these tax-free crypto countries offer significant advantages, consulting with tax professionals and legal experts will help you understand local laws and regulations.

In conclusion, the emergence of crypto tax havens reflects the importance of digital assets in the global financial landscape. As more countries recognise the potential of cryptocurrencies and blockchain technology, we may see further developments in tax policies aimed at attracting crypto investors and businesses. These ten countries stand out as the most attractive destinations for those seeking to minimise their crypto tax liabilities while participating in this rapidly evolving sector.

Reasons why some countries have no Crypto Tax

The absence of cryptocurrency taxation in certain jurisdictions stems from various strategic and economic factors. Understanding these dynamics provides insights into why some nations create tax-free digital asset environments.

Several countries have deliberately positioned themselves as crypto tax havens to attract investment and foster innovation. The European Parliament acknowledges this trend, noting that authorities should consider simplified tax treatment for occasional traders and small transactions.

Some nations view cryptocurrency tax exemptions as a means to stimulate economic growth. For instance, Germany’s approach reflects a strategy to encourage long-term investment by implementing a 0% capital gains tax on Bitcoin held for over a year. Likewise, Caribbean nations like the Bahamas and Bermuda have emerged as prominent tax havens in the crypto space.

Advantages: The primary benefit of tax-free crypto jurisdictions is their ability to attract international investment. These countries often provide strong legal frameworks that protect crypto transactions. Many offer developed financial ecosystems with accessible crypto exchanges and digital wallets, fostering a robust blockchain environment.

Disadvantages: Nevertheless, the International Monetary Fund highlights significant challenges associated with crypto tax havens. Cryptocurrencies’ pseudonymous nature makes enforcement difficult, potentially enabling tax evasion. Moreover, the rapid evolution of digital assets has left many tax systems struggling to adapt.

Legal Considerations

The legal framework surrounding crypto tax havens requires careful examination. According to the IMF, ownership of crypto assets appears heavily concentrated among relatively wealthy individuals, although holding patterns extend across various income levels. This concentration has prompted increasing scrutiny from policymakers worldwide.

Regulatory challenges persist as countries attempt to balance innovation with compliance. Implementing reporting obligations could drive users towards decentralised exchanges or peer-to-peer trades, where transactions occur without central oversight. Furthermore, the complexity of fundamental challenges posed by pseudonymity, rapid innovation, and vast information gaps create ongoing regulatory hurdles.

Some jurisdictions have established comprehensive legal frameworks to support their tax-free status. Belarus, for example, has legalised crypto activities and exempted individuals and businesses from crypto tax until 2023. Similarly, Malta has implemented the ‘Blockchain Act’ to provide clear legal guidelines for cryptocurrency activities while maintaining tax benefits.

It’s worth noting that tax offices and governments worldwide continue to develop their approach to cryptocurrency taxation. As the sector matures, some countries maintain zero-tax policies to attract investment, whereas others implement more stringent regulations to address concerns about financial stability and tax evasion.

Conclusion – Crypto Tax

Tax-free cryptocurrency jurisdictions represent a significant shift in global financial policy. These nations have established themselves attractive destinations for digital asset investors through strategic tax exemptions and supportive regulatory frameworks.

Different countries adopt varied approaches based on their economic goals and regulatory philosophies. While some nations like El Salvador embrace cryptocurrencies as legal tender with complete tax exemptions, others, such as Germany, offer targeted benefits for long-term holders. This diversity creates opportunities for investors seeking tax-efficient ways to manage their digital assets.

The success of crypto tax havens depends on their ability to balance innovation with regulatory compliance. Countries must address challenges related to pseudonymity, reporting requirements, and evolving technology while maintaining their competitive advantage. As cryptocurrency adoption grows, these jurisdictions will likely continue adapting their policies to remain attractive investment destinations.

Understanding the legal and regulatory landscape remains essential for cryptocurrency investors. Though tax-free jurisdictions offer significant advantages, considering broader factors such as financial infrastructure, political stability, and regulatory clarity should guide investment decisions.

How can I legally minimise my cryptocurrency tax liability?

There are several strategies to legally reduce your crypto tax burden. These include using specialised crypto tax software for accurate reporting, implementing tax-loss harvesting, carrying forward losses to offset future gains, utilising available tax allowances, and timing your sales strategically. Additionally, gifting or donating cryptocurrency can provide tax benefits in some jurisdictions.

Which countries are considered the most crypto-friendly for tax purposes?

Several countries have established themselves as crypto-friendly jurisdictions. Some notable examples include Switzerland, Singapore, Malta, and Portugal. These nations often offer favourable tax policies, clear regulatory frameworks, and supportive ecosystems for cryptocurrency businesses and investors.

How do crypto tax havens attract investment and foster innovation?

Crypto tax havens attract investment and foster innovation by implementing favourable tax policies, establishing clear regulatory frameworks, and creating supportive ecosystems for blockchain and cryptocurrency businesses. These jurisdictions often aim to position themselves as hubs for digital asset innovation, attracting investors and entrepreneurs in the sector.

What are the potential risks of investing in crypto tax-free countries?

While crypto tax-free countries offer significant advantages, there are potential risks. These may include regulatory uncertainty, as policies can change rapidly in this evolving sector. Additionally, some jurisdictions may lack more established financial centres’ robust financial infrastructure or political stability.