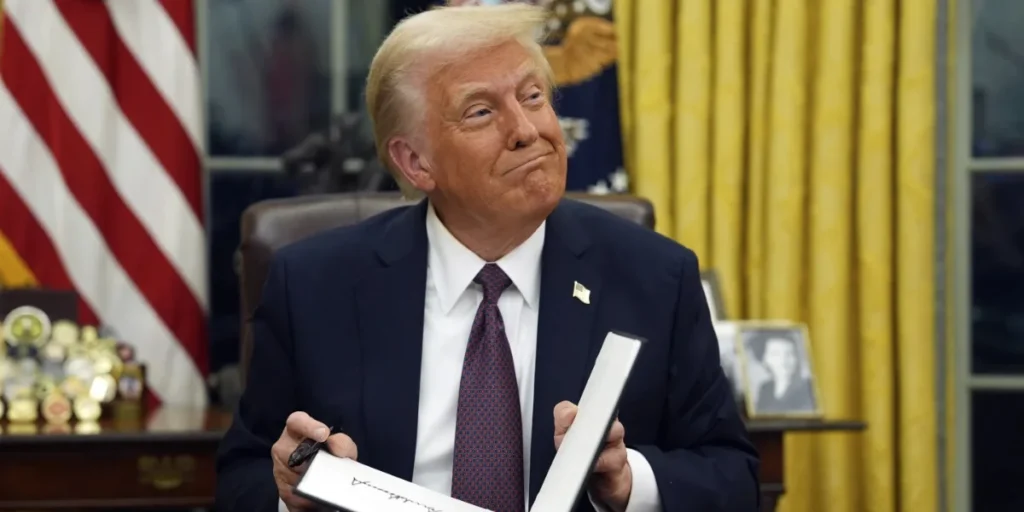

Trump’s new trade policy will reshape your financial future. The policy confirms a 25% tariff on Canadian and Mexican goods from February 2025. Chinese imports will face an extra 10% tariff too.

These bold trade measures could affect your investments and buying power by a lot. Global GDP might drop up to 2% in the next five years. The US GDP could fall by 0.7 percentage points in 2025 if other countries strike back. Currency markets and investment patterns might see radical changes. Trade relationships between the UK and its global partners face uncertainty.

Global Trade Changes Under Trump

Trump’s latest executive order signals a big change in US trade policy that will reshape global commerce. The United States plans to put a 25% tariff on all imports from Canada and Mexico, while Chinese goods will face a 10% duty.

New US tariff rates for 2025

The tariff structure shows clear differences between trading partners. Canadian energy resources, including oil, natural gas and electricity, will see a lower 10% rate. Chinese shipments worth less than £635.33 won’t have to pay these new duties. These rules start on March 12, 2025, and no country gets special treatment.

The economic effects could be huge since Canada, Brazil and Mexico are America’s biggest steel suppliers. Canada also supplies more than 50% of the aluminium that comes into the US as of 2024. American companies that use steel and aluminium have warned their products might cost more.

Why is Trump putting tariffs on Canada

The White House officially points to fentanyl trafficking and illegal immigration as the main reasons. Trump’s social media tells a different story. He says the US “pays hundreds of billions of dollars to subsidise Canada” and questions why they need Canadian imports at all.

The economic data paints a different picture. The US-Canada trade gap sits at about £47.65 billion each year. Energy purchases make up most of this gap, which doesn’t match Trump’s claim that America “doesn’t need anything they have”.

Justin Trudeau has responded with a £1.03 billion plan to boost border security. This includes new helicopters, technology and more staff. Canada has also put matching 25% tariffs on US imports worth up to £123.09 billion, including alcohol and fruit.

Impact on UK-US trade relations

British businesses and investors should watch these changes closely. The UK sent £179 billion in goods and services to the US in 2023 and bought £112 billion of US goods. The US stands as Britain’s biggest export market, with Germany following at just one-third the size.

Trump seems open to working with the UK on trade. He recently said that while Britain was “out of line” on trade matters, “that one can be worked out”. British negotiators might find this a good chance to talk, especially since services – the bulk of UK-US trade – usually face fewer tariff limits.

The changes could affect British exports like pharmaceutical products, cars and scientific instruments. Business Secretary Jonathan Reynolds thinks the UK should not face these tariffs because of Britain’s trade gap with the US. The British government still wants a “fair and balanced trading relationship which benefits both sides of the Atlantic”.

Currency Market Shifts

The US dollar’s strength keeps reshaping global currency markets and has reached its highest level since 1994 against major trading partners. This surge has happened even after two Federal Reserve rate cuts in 2024. The dollar index went up by 7% last year.

USD exchange rate predictions

The dollar will likely keep moving upward through 2025 for three main reasons. The US economy will grow by 2.7%, which beats other developed markets’ 1.7% forecast. The gap between US bond yields and those of trading partners has hit a 30-year high. Trump’s emphasis on domestic manufacturing and possible tariff measures could keep interest rates higher.

Right now, markets predict only 44 basis points of Fed rate cuts in 2025. The European Central Bank plans 110 basis points of reductions. This difference in monetary policy points to the dollar staying dominant, though its real effective exchange rate is two standard deviations above its 50-year average.

Effects on the British pound

The British sterling faces growing pressure from these currency changes. The pound saw its biggest one-day drop against the dollar since March 2023, falling 1.2% after Trump won the election. The sterling then dropped further to GBP 0.97 against the dollar.

The British currency faces several challenges:

- December 2024 showed the worst employment drop since November 2020

- Markets see an 85% chance of a Bank of England rate cut in February

- UK government bond yields have reached new highs – 10-year and 30-year gilts hit 15-year and 25-year peaks

Some analysts believe the sterling might show resilience. The Bank of England’s slower approach to easing rates compared to the European Central Bank could help the pound against the euro. The pound gained 4.6% against the euro in 2024.

Currency markets will likely become more volatile in early 2025. Trump’s trade policies and central bank decisions could push currencies beyond their 2024 trading ranges. While the dollar might stay strong short-term, America’s ongoing trade deficit at 4.2% of GDP could eventually weaken the currency.

British investors and businesses should watch these currency market changes carefully. The pound’s value against both the US Dollar and Euro depends largely on how well the UK government tackles recent growth problems. Higher borrowing costs or slow growth might limit policy options, which could affect currency rates.

Investment Opportunities in Asia

Southeast Asia’s economic map has changed dramatically. Trump’s trade policies have reshaped how global manufacturing works. This region now sees new possibilities and hurdles as US-China tensions rise.

Manufacturing move to Vietnam and India

Vietnam has become the top choice for companies looking to move away from China. The numbers tell an interesting story – Vietnam now produces almost 40% of all ASEAN exports headed to North America. Big names like Intel and Nike have set up major operations there.

Yet Vietnamese manufacturers worry about possible US tariffs. An AmCham Vietnam study shows that two-thirds of manufacturers might need to cut jobs if Trump brings in new trade rules. This makes sense since Vietnam has the fourth-largest trade surplus with the US among all trading partners.

Vietnam has plans to deal with these risks:

- Building new trade deals with the European Union and Middle East

- Making local supply chains stronger

- Teaching workers high-tech skills

India wants to be another option for manufacturing. The country’s latest budget shows this through lower tariffs on US goods. On top of that, tech giants like Apple have started doing more than just assembly and sales in India.

Growing markets in Southeast Asia

Trump’s policies bring challenges but they’ve also pushed regional economies closer together. Indonesia joined BRICS in early 2025, which marks a big change. Malaysia, Thailand, and Vietnam are now BRICS partner countries, which shows they want more options.

These countries now work more freely with new partners through different groups. Thailand has jumped from 13th to fifth place in trade surplus with the US, ahead of Japan and South Korea. This 343% growth since 2017 shows how much stronger the region has become.

Southeast Asian nations keep making their systems better:

- Singapore and Malaysia have strong banking systems

- Indonesia keeps its foreign policy independent and active

- The Philippines builds stronger security ties with US allies like Japan and Australia

Trade patterns keep changing too. Chinese exports to emerging markets have grown from 16% in 2000 to 44% in 2023. At the same time, China’s exports to the US dropped from 21% to 16%.

British investors can find great opportunities here. The region stands on its own feet more and more. Better systems and growing independence create chances to invest in manufacturing, technology, and financial services. Learning about these changes matters as Southeast Asia grows into a key part of global supply chains.

Safe Haven Assets

As trade tensions rise, investors are turning their attention to safe-haven assets to find stability in these uncertain times. Your investment portfolio should include defensive positions in gold, government bonds, and real estate.

Gold price forecasts

Gold prices have reached a new high of GBP 2,347.66 per ounce in February 2025. This marks the eleventh record this year, and Trump’s tariff announcements have been the main driver.

Goldman Sachs has raised its gold price forecast to GBP 2,461.90 for the end of 2025. The bank points to higher central bank demand as the reason. More traditional investors now see gold as a way to protect against rising inflation and economic uncertainty.

The spot gold price stands at GBP 2,333.74, just GBP 4.92 below its highest level ever. Market analysts say this strong performance comes from:

- More people wanting safe-haven assets due to trade policy uncertainty

- Central banks buying large amounts

- Possible supply shortages in Europe

- Growing worries about global economic stability

Government bonds outlook

Bond market volatility has increased as investors try to understand Trump’s fiscal policies. The 10-year Treasury yield has dropped to just under 4.5% from about 4.8% in mid-January. Bond investors are playing it safe and staying away from long-term positions while policies remain unclear.

The US fiscal deficit has become a major challenge. It jumped from 3.1% of GDP in 2016 to over 6% in 2024. The Treasury needs to issue about GBP 11.59 trillion in bonds over the next two years to cover this gap.

Real estate investment trends

Trump’s second term could reshape the commercial real estate scene. Looser fiscal policy might help occupier performance in the short term, but investors should watch several factors:

The stricter immigration rules could push up costs in hospitality, manufacturing, and construction. Higher tariffs might hurt industrial and retail sectors as consumers end up paying more.

Property yields need to stay competitive compared to 10-year Treasuries. More buildings are being converted from offices to homes, thanks to the proposed Revitalising Downtowns and Main Streets Act that offers tax credits.

Real estate investors should focus on:

- Getting investment structures ready for 2025 tax changes

- Looking at conversion opportunities under proposed tax credit programmes

- Watching how trade policies affect construction costs

- Making the most of energy credits in development projects

Higher insurance costs combined with interest rates have reduced the money available for new investments. This hits development projects especially hard because both construction insurance and financing have become more expensive.

Stock Market Sectors to Watch

Stock markets have become more volatile as defence and energy sectors react strongly to President Trump’s policy changes. Market data shows big swings across these sectors. This creates both risks and opportunities for British investors.

Defence companies

European defence stocks jumped after Trump made controversial NATO comments. The pan-European defence index rose 1% in just one trading session. Big arms manufacturers like Rheinmetall, Dassault Aviation, Leonardo, and Saab saw gains of 2-3%.

Trump’s call made stocks rally when he asked European NATO members to raise their defence spending to 5% of GDP from the current 2% threshold. Germany’s economy minister responded by suggesting they could spend about 3.5% of their GDP on defence.

The market quickly changed direction after Trump suggested cutting US defence spending in half. His statement about reducing the military budget by GBP 0.79 trillion led to immediate market reactions:

- Lockheed Martin shares dropped 1.6%

- Northrop Grumman declined 3.4%

- General Dynamics fell 2.1%

These changes show how sensitive the sector is to political statements and policy shifts. Smaller defence contractors like Huntington Ingalls Industries face tough times, having lost almost 25% of their value in five years.

Energy stocks

The energy sector shows impressive strength despite policy changes. Trump’s “drill, baby, drill” approach points to a major change in US energy policy. His administration has taken several steps:

- Cancelled the target for 50% of US auto sales to be electric vehicles by 2030

- Ordered an end to EV subsidies

- Reversed Biden-era pause on LNG export project approvals

- Stopped offshore wind development

These policy shifts have caused major market movements. Energy companies focused on traditional fossil fuels have done better than the broader market since Trump’s election. Oil majors and drilling service providers show strong performance.

The International Energy Agency predicts oil markets will have a surplus of more than 1 million barrels daily next year. China’s changing energy use patterns – especially its quick move to electric vehicles and high-speed rail – could slow oil demand growth.

British investors should know that even though Trump’s policies favour traditional energy companies, clean energy might still thrive. Clean energy stocks actually did well during his first term when interest rates were lower. With the Federal Reserve likely to cut rates twice in 2025, rate-sensitive clean energy stocks could benefit.

The sector’s future depends on several factors:

- Possible changes in drilling permit rules

- Changes in global demand, especially in emerging markets

- Infrastructure development policies

- International trade relationships

- Federal Reserve’s interest rate decisions

These market changes give UK-based investors unique things to think about when investing in US energy and defence sectors as Trump’s policies take effect.

Wrapping Up

Your investment portfolio will see major changes through 2025 with Trump’s return. His planned 25% tariff on Canadian and Mexican goods and 10% duty on Chinese imports might shake up markets. These changes also open up new strategic possibilities.

British investors now see a mix of hurdles and opportunities ahead. The pound’s recent 1.2% fall against the dollar after Trump’s win means investors just need to watch their currency exposure carefully. Market swings might increase, but safe options like gold, currently at GBP 2,333.74, could provide stability.

New opportunities are emerging in Southeast Asia. Manufacturing moves to Vietnam and India have created fresh investment possibilities. Defence stocks are gaining momentum – European defence indices rose 1% after Trump’s NATO remarks. His energy policies could transform both traditional and clean energy investments.

Success in this investment climate comes from having a well-balanced portfolio that adapts to these policy changes. You should broaden your investments in different regions and asset classes. Keep track of currency shifts and safe-haven opportunities closely. Market swings are a great way to get entry points for investors who stay informed and plan ahead.